|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

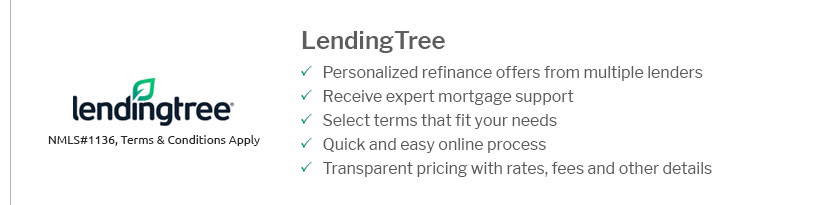

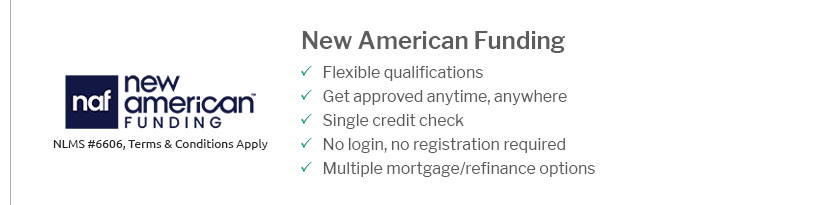

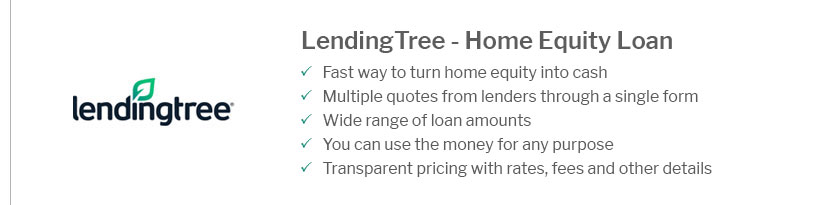

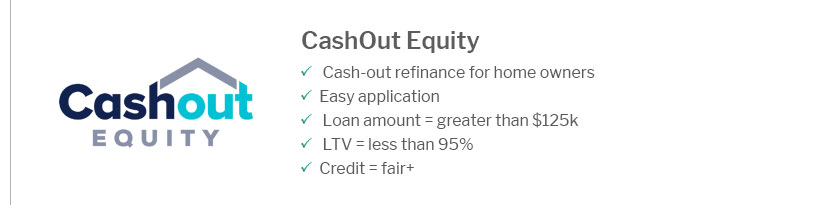

Best Company to Refinance With: Top Choices and ConsiderationsRefinancing your home can be a strategic move to reduce interest rates and monthly payments. Choosing the best company to refinance with is crucial. This article explores top contenders and what to expect from the process. Understanding Refinancing OptionsRefinancing involves replacing your current mortgage with a new one, often at a lower interest rate. It’s essential to understand the different types of refinancing available. Rate-and-Term RefinanceThis option allows homeowners to change the interest rate, loan term, or both. It’s popular among those seeking lower monthly payments. Cash-Out RefinanceWith this option, you can access your home’s equity and receive cash in hand. It’s suitable for those needing funds for significant expenses. Top Companies for RefinancingChoosing the right lender can make a substantial difference. Here are some top companies recognized for their refinancing services.

For those interested in specific rates, home mortgage rates in Rochester NY offer competitive options worth exploring. Factors to Consider When Choosing a RefinancerBefore committing to a refinancing company, consider these crucial factors. Interest RatesCompare rates from different lenders to ensure you’re getting the best deal possible. Fees and Closing CostsBe aware of any fees associated with refinancing, such as closing costs, which can add up. Customer ReviewsRead reviews and testimonials to gauge customer satisfaction with a lender’s service. Additionally, if you qualify, low income home mortgage loans might provide beneficial refinancing options tailored to your financial situation. FAQ

https://www.creditkarma.com/shop/autos/index/type/refinance

Your options for refinancing ; AUTOPAY logo. 3424 Reviews. $2,102 ; Caribou logo. 671 Reviews. $1,419 ; Tresl logo. 1406 Reviews. $908 ; Ally logo. 89 Reviews. $860 ... https://www.nerdwallet.com/refinancing-student-loans

Top lender interest rates ; LendKey Student Loan Refinance - 4.5 - COMPARE RATES on Credible's website. on Credible's website. 4.89- 9.04%. 680 ; ELFI Student ... https://www.consumeraffairs.com/finance/finance__companies.htm

New American Funding is the best lender for loan variety, offering several FHA loans, USDA loans and HELOCs. The company is also known for its ...

|

|---|